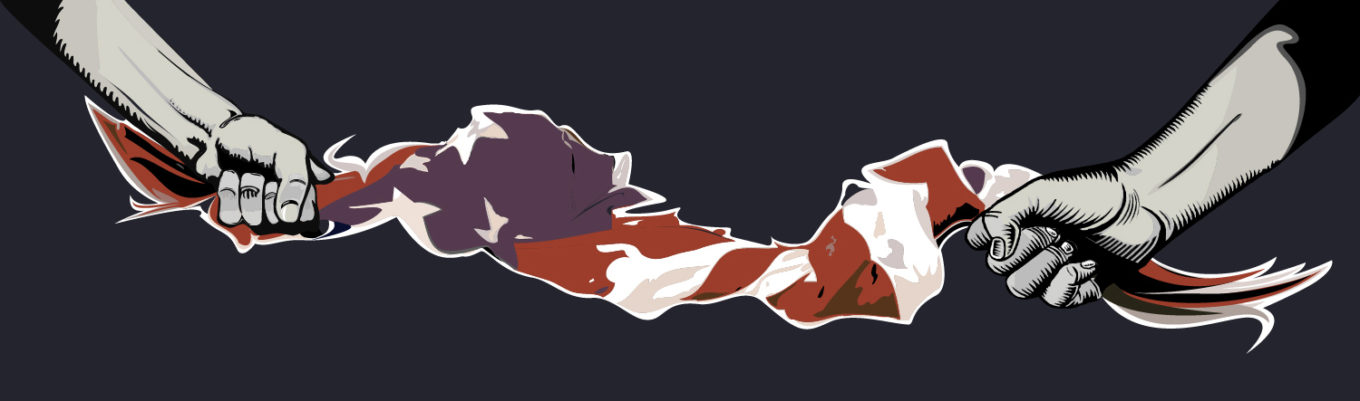

[Despite a huge corporate tax cut, Bank of America is capitalizing on its low-income customers by killing its last free checking account.

Last month, corporations scored a huge win as Congress slashed their tax rate from 35 to 21 percent, but that hasn’t stopped them from shutting down plants, closing stores and laying off thousands of workers. However, Bank of America was one of a score of financial institutions to give out employee bonuses following the tax cuts, a move that conservatives have cited as evidence of corporations’ commitment to the average American.

Now Bank of America is joining most large banks that don’t offer basic banking services without requiring consumers to pay fees.

To avoid a new fee, Bank of America’s eBanking customers must maintain minimum balances of $1,500 or receive direct deposits of at least $250 per month. If one of those things doesn’t happen each month, they owe the bank $12.

As it was, Bank of America stopped offering this type of account several years ago, and it was only free if customers didn’t receive paper statements or use bank teller services – things that many of us would consider among the perks of not keeping all of your money under your mattress. In the past, if eBanking customers asked for paper statements or visited a teller, they owed a monthly fee of about $9.

Now, Bank of America’s cheapest option is a Safe Checking account that doesn’t actually include checks and that requires a monthly fee of about $5.

Contact Mollie Bryant at 405-990-0988 or bryant@bigiftrue.org. Follow her on Facebook, Twitter and Tumblr.